22+ reverse mortgage faqs

How does a reverse mortgage work. Usually that cost around 125 is.

Reverse Mortgages Questions And Answers

Find us on social media.

. Web 1 day agoThe 30-year fixed rate mortgage has run north of 6 all year. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it. Web A reverse mortgage is repaid when the last borrower or even the last eligible non-borrowing spouse leaves the house or passes away.

Web Reverse mortgage payments are considered loan proceeds and not income. Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web Your reverse mortgage will have to be repaid when the last surviving borrower on the loan passes away moves from the home permanently or does not occupy the home for longer than 12 months.

Interest on a reverse mortgage is not tax-deductible until the borrower makes partial or full re. What are my obligations. Web Types of reverse mortgages.

Web 17 hours agoGetty. 1 Unlike a traditional mortgage in which the borrower pays back the lender over time with a reverse mortgage the lender. When does the Reverse Mortgage need to.

Web Reverse Mortgage FAQs - Most Frequently Asked Questions. A reverse cooperative apartment unit loan is a proprietary reverse mortgage secured by a borrowers interest. Be age 62 or older Own the property.

The average rate for refinancing a 30-year fixed mortgage is currently 705 according to Bankrate. 1-510-722-7868 email protected Facebook. How much can you qualify for.

Web Get answers to frequently asked mortgage questions with RMFs list of loan FAQs. A reverse mortgage is a loan that allows homeowners 62 years of age and older to use their equity to generate tax-free income without having to sell the home or take on a new mortgage payment. A reverse mortgage works differently than a traditional mortgage loan though.

A year ago the 30-year fixed-rate was 416. Ad If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. 4-hour expedite service available.

Find the full list of reverse mortgage questions answers and information here. Web The second referred to as a proprietary reverse mortgage is a mortgage loan that is made in accordance with the requirements of New York State Law. Curative department to cure liens.

What if I dont meet my reverse mortgage. Changing from full-time to part-time occupancy may be okay. Yes You will retain the title and ownership of the home.

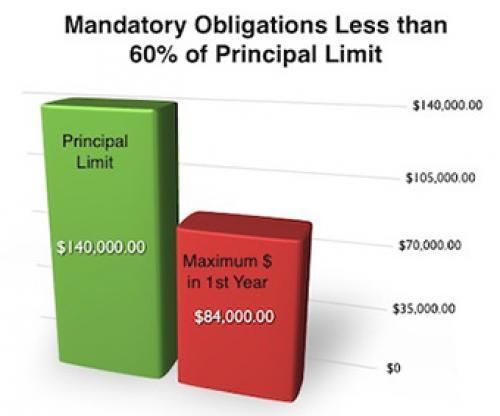

A reverse mortgage loan is generally not repaid until the homeowner passes away or permanently moves out of the. Web The borrower must pay an initial one-time premium for the FHA insurance equal to 2 of the loan amount. There are three common types of reverse mortgage loans.

Does the bank take title to my home. Checking liens judgments deeds mortgages taxes. For the week ending March 16 it averaged 660 down from 673 the week before.

For refinancing a 15-year. Compare Pros Cons of Reverse Mortgages. Web The borrower remains responsible for property taxes hazard insurance and home maintenance and failure to pay these amounts may result in the loss of the home.

Do I still own my home. Home Equity Conversion Mortgage HECM This type of mortgage for homeowners 62 is insured by the Federal Housing Administration FHA and can eliminate monthly. A home equity loan typically must be repaid over 5 or 10 years.

What are the benefits of a reverse mortgage. Before you get a reverse mortgage you must meet with a reverse mortgage counselor and there is a fee associated with that consultation. Web Reverse Mortgage FAQs What is a reverse mortgage.

2 Because the. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. As long as you havent established another home as your principal residence and continue to occupy your HECM-liened.

The lender pays you the borrower loan proceeds in a lump sum a monthly advance a line of credit or a combination of all three while you continue to live in your home. Instead of making payments to your lender. Actually right here is a great place to start.

Review 2023s Best Reverse Mortgage Lenders. Web Frequently Asked Questions About Reverse Mortgages Expand All What is a reverse mortgage. Web A homeowner must be at least 62 years old to apply for a reverse mortgage loan.

Compare a Reverse Mortgage with Traditional Home Equity Loans. Compare a Reverse Mortgage with Traditional Home Equity Loans. Web Reverse Mortgage Frequently Asked Questions Browse below for answers to some of ARLOs most frequently asked questions.

Web A reverse mortgage is a loan that allows homeowners who are 62 or older borrow against a portion of the equity in their home. Looking For Senior Reverse Mortgage Lender. Web Generally if youre getting a Federal Housing Administration FHA reverse mortgage also known as a home equity conversion mortgage HECM you must.

Compare Top Lenders and Learn Pros Cons. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Web If you move the reverse mortgage becomes due and payable.

The rate on a 30-year fixed refinance decreased today. You can get a reverse mortgage through a reverse mortgage lender. Skip The Bank Save.

Ad ProTitleUSA is Nationwide Title and Tax Due Diligence. Just click on a question. Ad All About Reverse Mortgage For Seniors.

Ad Free Reverse Mortgage Information. Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. Weve taken some of the reverse mortgage frequently asked questions we hear most often and answered them for you belowincluding helpful links to more detailed information.

After that the premium is 05 of the outstanding loan balance annually. Typically the home is sold and the proceeds from the sale are used to pay back the loan. Ad Use Our Comparison Site Find Out Which Lender Suits You Best.

The heirs will receive any. Depending on the type of reverse mortgage you received you or your. Web A reverse mortgage is a type of loan that allows homeowners age 62 and older to convert part of their home equity into income.

Yqxdnyazdxn Om

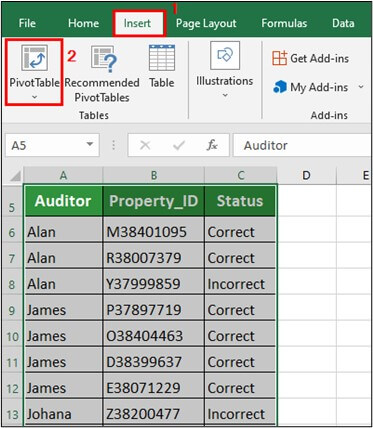

Pivot Table In Excel Examples How To Create Pivot Table

Reverse Mortgages Questions And Answers

Reverse Mortgage Hecm Distribution Alternatives Reverse Mortgage Guide Section 2 Article 4 Hsh Com

Reverse Mortgage Intercap Lending

5 Rules That Apply To Reverse Mortgages In 2023

Global Mortgage Mexico Lending Los Cabos Guide

Mortgage Broker Home Loan Mortgage Specialist 1st Choice Mortgage Boise Meridian Nampa Caldwell

What Is A Reverse Mortgage Visual Ly

20 Hour Safe Loan Originator Pre Licensing Slides 2017 2018

5xv2fa83dmqzwm

All Reverse Mortgage Inc Reviews Reversemotgagereviews Org

Reverse Mortgage Faqs Reverse Mortgage

Faqs And Resources In California The Reverse Mortgage Group

The Reminder March 15 2023 By Beacon Communications Issuu

Reverse Mortgages In 2023 Complete Guide On How They Work Reversemortgagereviews Org

Demo Zone Lc Moody S Live